Money placed in an annuity is illiquid and subject to withdrawal penalties so this option isn’t recommended for younger individuals or those with liquidity needs. Annuity holders can’t outlive their income stream and this hedges longevity risk. The present value of an annuity is the total value of all of future annuity payments.

Annuity Payment Factor Calculator (PV)

One way to help maintain a regular income in your golden years is by buying annuities. With an annuity, you pay a lump sum to an insurance company in return for a guaranteed income stream. Finally, you can consider a guaranteed lifetime withdrawal benefit annuity (GLWB). This is an additional feature, called a rider, on either a tax-deferred fixed or variable annuity (based what is an annuity factor on the underlying investment within the annuity). An annuity with a GLWB provides guaranteed income for life even if the underlying investment account value (meaning the annuity’s) has been depleted. It’s important to note that tax-deferred fixed annuities have surrender charges and aren’t intended for people who need access to their assets during the guarantee period.

Table of Contents

This can be avoided by arranging a survivorship annuity or one that allows passing the value on to beneficiaries. It’s also important to consider the impact of signing away a substantial amount of cash. If it’s needed in the future, the buyer of an annuity faces substantial withdrawal restrictions and penalties. Daniel has 10+ years of experience reporting on investments and personal finance for outlets like AARP Bulletin and Exceptional magazine, in addition to being a column writer for Fatherly. No Index Party is a fiduciary or agent of any purchaser, seller or holder of a Fixed Indexed Annuity. Obligations to make payments under the Fixed Indexed Annuities are solely the obligation of NLA.

Ask a Financial Professional Any Question

For those considering annuities to meet retirement expenses, here’s what to anticipate from a $500,000 monthly payout. Athene sold 34.6 billion in fixed annuities in 2023, the most of any company reviewed by LIMBRA. Athene Agility annuities are guaranteed not to lose money and provide a guaranteed income stream with a death benefit rider at no additional charge. A variable annuity is invested in stock funds that typically keep pace with inflation.

Summary

However, tax-deferred fixed annuities can offer some penalty-free liquidity, equivalent to 10% of the contract amount, for unexpected events or to satisfy required minimum distributions from retirement accounts. To use an annuity table effectively, you first need to determine the timing of your payments. Are they received at the end of the contract period, as is typical with an ordinary annuity, or at the beginning? Because most fixed annuity contracts distribute payments at the end of the period, we’ve used ordinary annuity present value calculations for our examples.

- In this case, the buyer decides how the money will be invested, selecting from a menu of mutual funds that go into a personal “sub-account.”

- This variance in when the payments are made results in different present and future value calculations.

- Using an annuity calculator or a financial spreadsheet set up for calculating the present value of an annuity is often more precise than using the preset annuity table.

- Using this, an individual can make maximum drawings depending on their present value.

- Annuities are designed to provide a steady cash flow for people during their retirement years to alleviate the fear of outliving their assets.

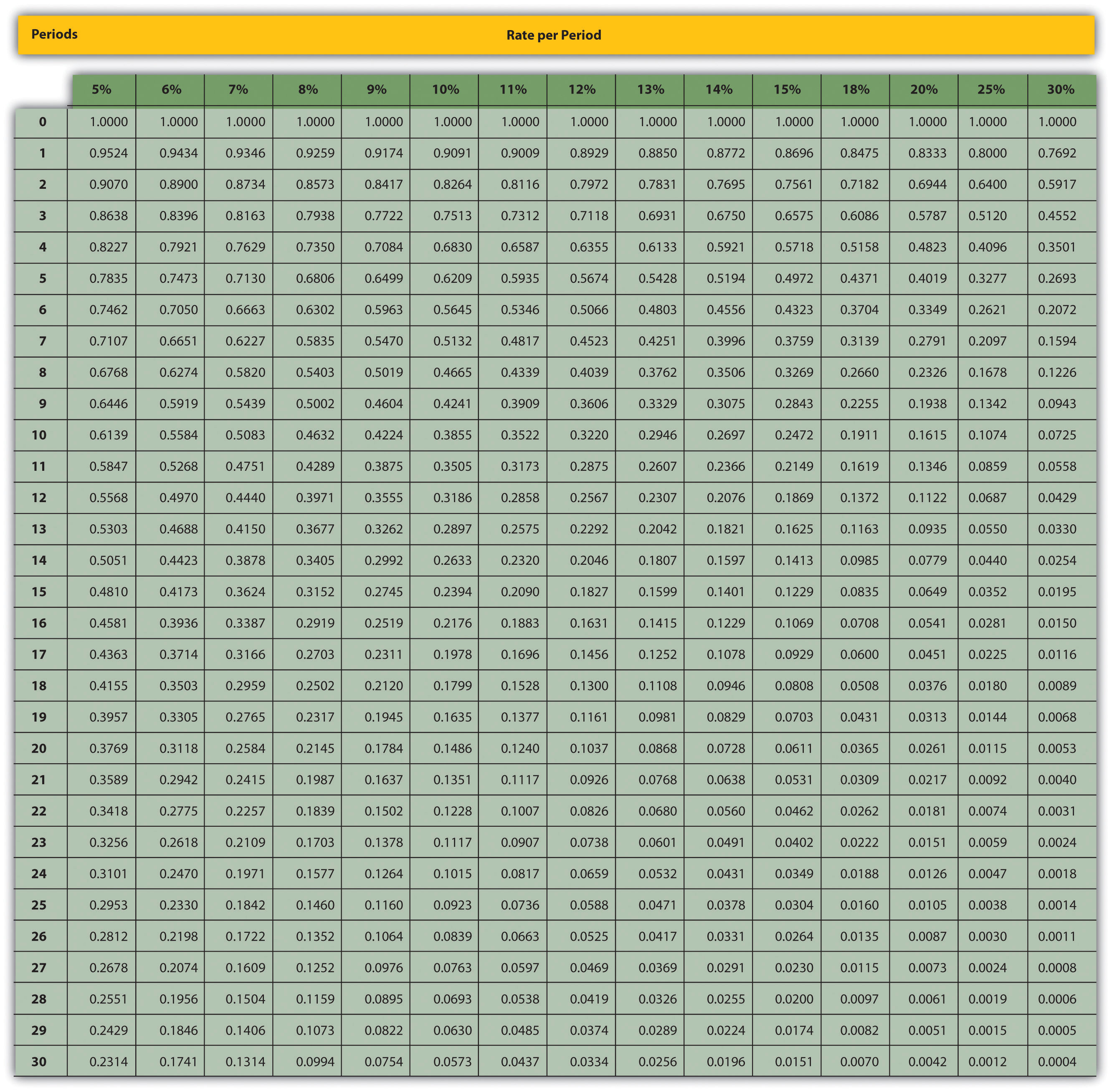

Annuity tables are visual tools that help make otherwise complex mathematical formulas much easier to calculate. They lay the calculations for predetermined numbers of periodic payments against various annuity rates in a table format. You cross reference the rows and columns to find your annuity’s present value. An annuity table, often referred to as a “present value table,” is a financial tool that simplifies the process of calculating the present value of an ordinary annuity. By finding the present value interest factor of an annuity (PVIFA) on the table, you can easily determine the current worth of your annuity payments. Annuities are appropriate financial products for individuals who seek stable, guaranteed retirement income.

On the other hand, the future value of an annuity will be greater than the sum of the individual payments or receipts because interest is accumulated on the payments. The value today of a series of equal payments or receipts to be made or received on specified future dates is called the present value of an annuity. Working with a fiduciary financial advisor is beneficial because they are legally required to act in your best interests, ensuring you receive transparent and accountable financial advice. This commitment fosters trust and helps you make informed decisions regarding your financial future. Fiduciary advisors are legally bound to prioritize clients’ best interests, providing transparent and accountable advice on annuities and other financial products. Working with a trusted advisor can benefit you greatly when deciding who to trust with managing your retirement account and making sure you have steady retirement income.

They pay for the annuity either with a lump sum or with a series of payments over time. Annuities are long-term insurance products particularly suitable for retirement assets. Annuities held within qualified plans do not provide any additional tax benefit. Early withdrawals may be subject to surrender charges, recovery of non-vested premium bonus, market value adjustment and applicable fees. Withdrawals are subject to ordinary income tax, and if taken prior to age 59½, a 10% IRS penalty may also apply.